Swing and Positional Trading Using Supertrend

What You Will Learn

How to trade swing and positional setups using Supertrend and Slow Stochastic indicators

A clear, rule-based strategy with defined entry, exit & stop-loss

How to apply the strategy in real market conditions with chart-based examples

How to build and use a stock scanner dashboard to identify trades

Risk management to protect capital and improve consistency

Your Course Overview

6 sections • 10 topics • 1 hr 15 mins content

1. Introduction

1 min

Meet your Instructor

Start Learning

2. Basics of Technical Analysis

4 mins

Dow theory

Start Learning

3. Foundation of Strategy

14 mins

Overview of strategy

Start Learning

Supertrend indicator

Start Learning

Slow stochastic indicator

Start Learning

4. Swing Strategy Setup

28 mins

Entry & exit

Start Learning

Strategy application and examples

Start Learning

5. Scanner for Stock Selection

17 mins

Entry & exit dashboard & scanner

Start Learning

Dashboard for shortlisting stocks

Download

6. Risk Management

9 mins

Understanding risk management

Start Learning

About The Course

Swing and Positional Trading Using Supertrend course is a practical and easy-to-follow program designed for traders who want to capture short- to medium-term market moves using a proven strategy built around the Supertrend and Slow Stochastic indicators. You will learn how to trade with a clear set of rules, apply the strategy on real charts, and manage risk effectively. This course also walks you through building a stock scanner and dashboard to find high-potential trade setups for both bullish and bearish. Whether you’re a new or experienced trader, this course will help you simplify your trading process and gain confidence in executing swing and positional trades.

In Lesson 1, Introduction, you will meet your instructor and understand the flow of the course.

In Lesson 2, Basics of Technical Analysis, you will learn the core principles of Dow Theory and how they apply to price action and trend analysis.

In Lesson 3, Foundation of Strategy, you will explore the complete strategy setup, including how to use the Supertrend and Slow Stochastic indicators together to identify high-probability trades.

In Lesson 4, Swing Strategy Setup, you will understand how to apply the strategy in real markets, with clear entry and exit rules and chart-based examples.

In Lesson 5, Scanner for Stock Selection, you will learn how to make and use a scanner & dashboard to find trade-ready stocks based on strategy parameters.

In Lesson 6, Risk Management, you will explore how to manage capital, define position sizes, and use stop-losses effectively to protect your trades.

Course Highlights :

- How to trade swing and positional setups using Supertrend and Slow Stochastic indicators

- A clear, rule-based strategy with defined entry, exit & stop-loss

- How to apply the strategy in real market conditions with chart-based examples

- How to build and use a stock scanner dashboard to identify trades

- Risk management to protect capital and improve consistency

Who is this course for :

- Swing and positional traders seeking a structured, indicator-based strategy

- Beginners who want to avoid complex setups and trade with clear rules

- Traders who want to learn how to use Supertrend and Stochastic effectively

- Working professional or positional traders looking for reliable stock scanners

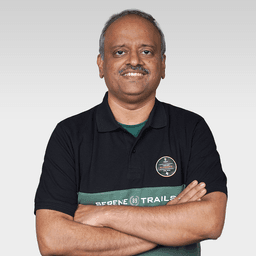

Learn From - Milind Upasani

Founder, Learn2Invest

Full-Time Trader

25+ Years

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.Frequently Asked Questions

Do I need prior trading experience?

Is this strategy suitable for both swing and positional trading?

Which indicators are used in this strategy?

Will I learn how to make and use stock scanners for trade opportunities?

How long will I have access to this course?

Will I get a certificate of completion?

Why is this course so affordable?

₹---

This Course is not included in PRO