Butterfly Option Trading Strategy

What You Will Learn

Basics of options trading

How to construct and execute Butterfly trades for consistent profits

Identifying the best stocks and market conditions to apply the strategy

Position sizing and risk management to protect your capital

Real-world trade examples to help you apply the strategy in live markets

Your Course Overview

10 sections • 21 topics • 2 hrs 30 mins content

1. Basics of Options

34 mins

Meet your instructor

Start Learning

Basics of options

Start Learning

Option trading strategies

Start Learning

Option Greeks

Start Learning

2. Understanding Butterfly Strategy

17 mins

Basics of butterfly strategy

Start Learning

Logic of the strategy

Start Learning

Directional strategy

Start Learning

3. Trend Identification

15 mins

How to identify the trend

Start Learning

4. Rules of the strategy

6 mins

Rules of the strategy

Start Learning

5. Adjustments

19 mins

How to make adjustments

Start Learning

Example

Start Learning

6. Advanced Adjustments

17 mins

Advanced adjustments

Start Learning

Pyramiding

Start Learning

7. Trading Strategy

9 mins

Trading Strategy

Start Learning

8. Weekly Expiry

5 mins

Weekly Expiry

Start Learning

9. Risk Management

1 min

How to manage risk

Start Learning

10. Case Studies

21 mins

Case study - I

Start Learning

Case study - II

Start Learning

Case study - III

Start Learning

Case study - IV

Start Learning

Case study - V

Start Learning

About The Course

This course will take you from the basics of options to a rule-based approach for executing, adjusting, and managing Butterfly trades effectively. This is a directional trading strategy suitable for traders looking for a low-risk, high-reward setup. You will learn to find the right stocks, execute trades with correct entry, exit, and stop-loss, and manage risk effectively.

In Lesson 1, Basics of Options, you will meet your instructor and learn the basics of option trading.

In Lesson 2, Understanding Butterfly Strategy, you will be introduced to the butterfly option trading strategy. You will learn how to construct and execute Butterfly trades for consistent profits

In Lesson 3, Trend Identification, you will learn to identify the trend accurately.

In Lesson 4, Rules of the Strategy, you will understand the rules of the strategy.

In Lesson 5, Adjustments, you will learn practical methods to modify trades and maximize profits or limit losses.

In Lesson 6, Advanced Adjustments, you will learn advanced adjustment techniques, including pyramiding.

In Lesson 7, Trading Strategy, you will learn to execute the strategy with correct entry, exit and stop-loss.

In Lesson 8, Weekly Expiry, you will learn how to adjust the strategy for weekly expiry.

In Lesson 9, Risk Management, you will learn risk management and position sizing techniques to protect your capital.

In Lesson 10, Case Studies, you will learn to execute the strategy using practical examples.

Course Highlights :

- Basics of options trading

- How to construct and execute Butterfly trades for consistent profits

- Identifying the best stocks and market conditions to apply the strategy

- Position sizing and risk management to protect your capital

- Real-world trade examples to help you apply the strategy in live markets

Who is this course for :

- Traders looking for a directional trading strategy

- Part-time traders or students looking for a profitable option trading strategy

- Traders looking for a tested and low-risk option trading strategy

- Traders who prefer rule-based, disciplined trading approaches over discretionary or impulsive trading styles

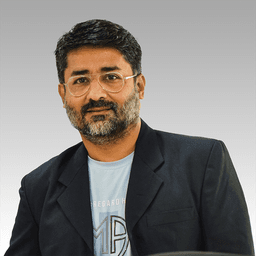

Learn From - Yogesh Nanda

Yogesh Nanda

He is a Chartered Accountant by qualification, is one of the most sought-after mentors in the stock market, bringing over 15 years of experience in trading and investing. He is renowned for his methodical and rule-based approach to trading. His Iron Condor strategy—a masterpiece of simplicity and precision—is now adopted by over 600,000 traders worldwide, helping them achieve consistent and reliable results. A regular contributor to Moneycontrol, his insights are valued for their clarity, depth, and practical relevance.Frequently Asked Questions

Can I trade this strategy part-time?

Will I get real trade examples?

How long will I have access to this course?

Will I get a certificate of completion?

Why is this course so affordable?

₹---

1131 learners have enrolled