ETF Investing Strategy by Milind Upasani

What You Will Learn

How to read price through candlestick patterns and Dow Theory

Basics of moving averages and how they help in decision-making

Core principles of ETF investing and strategic entry points

How to build a balanced ETF portfolio using technical signals

Your Course Overview

6 sections • 13 topics • 7 hrs 34 mins content

1. Introduction

46 mins

Why techno funda analysis

Start Learning

2. Basics of Technical Analysis

2 hrs

Understanding price through candles

Start Learning

Dow theory - I

Start Learning

Dow theory - II

Start Learning

Dow theory - III

Start Learning

3. Technical Indicators

1 hr

Basics of moving averages - I

Start Learning

Basics of moving averages - II

Start Learning

4. What is ETF Investing

1 hr

Basics of ETF investing

Start Learning

ETF investing strategy

Start Learning

5. Portfolio Management and Trading Psychology

1 hr

How to manage portfolio effectively

Start Learning

Understanding trading psychology

Start Learning

6. Next Step

1 min

How to take your trading skills to the next level

Start Learning

Trading Mentorship Program by Milind Upasani

Download

About The Course

ETF Investing Strategy by Milind Upasani is a practical course that uses technical insights with ETF investing, ideal for anyone looking to build a strong, low-risk portfolio. Starting with the fundamentals of price analysis, this course introduces the concept of technofunda analysis, the combination of technical tools with good investing principles.

In Lesson 1: Introduction, you will learn the importance of combining technical and fundamental approaches for smarter investment decisions.

In Lesson 2: Basics of Technical Analysis, you will understand price movement through candlestick structures and explore Dow Theory in detail to identify trends and market behavior.

In Lesson 3: Technical Indicator, you will gain clarity on moving averages and how they are used to track price momentum and confirm trends.

In Lesson 4: What is ETF Investing, you will explore the fundamentals of Exchange Traded Funds (ETFs) and learn a practical ETF investing strategy that aligns with technical signals.

In Lesson 5: Portfolio Management and Trading Psychology, you will understand how to manage your portfolio wisely and build the mental discipline required for long-term investing success.

Course Highlights :

- How to read price through candlestick patterns and Dow Theory

- Basics of moving averages and how they help in decision-making

- Core principles of ETF investing and strategic entry points

- How to build a balanced ETF portfolio using technical signals

Who is this course for :

- Beginners looking to get started with ETF investing

- Investors who want to combine technical analysis with long-term strategies

- Working professionals seeking passive investing methods

- Anyone wanting to do swing trading in ETFs

- Traders aiming to diversify their approach with ETFs

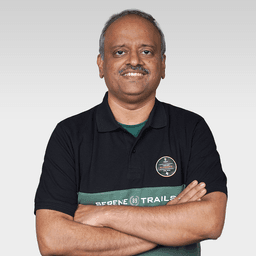

Learn From - Milind Upasani

Founder, Learn2Invest

Full-Time Trader

25+ Years

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.

Frequently Asked Questions

Do I need prior knowledge of the stock market?

Can I use this course for both trading and investing?

Will I get real examples of trades?

How long will I have access to this course?

Will I get a certificate of completion?

₹---

1011 learners have enrolled