Equity Arbitrage Strategy Using Futures & Options

What You Will Learn

Learn how to execute arbitrage trades using futures and options

Identify low-risk opportunities between spot and derivative markets

A practical arbitrage strategy using real market instruments

Manage capital efficiently while limiting directional risk

Your Course Overview

2 sections • 3 topics • 38 mins 19 sec content

1. Introduction

2 mins

Course introduction

Start Learning

2. Arbitrage Trading Using F&O

35 mins

Equity & future arbitrage trading

Start Learning

Equity & options arbitrage trading

Start Learning

About The Course

Equity Arbitrage Strategy Using Futures & Options is a practical course designed to help you understand and execute low-risk trading strategies using price differences between the equity (cash) market and derivatives. Perfect for traders who want to reduce market risk while still taking advantage of profit opportunities, this course introduces you to Futures & Options-based arbitrage techniques used by professionals. You will learn how to spot arbitrage opportunities between equities and futures or options, structure trades, and manage positions without relying on market direction. Whether you’re a conservative trader or looking to diversify your trading toolkit, this course provides a reliable, practical approach to arbitrage trading.

In Lesson 1, Introduction, you will get an overview of the course, its objectives, and how arbitrage trading fits into a broader market strategy.

In Lesson 2, Arbitrage Trading Using F&O, you will explore how to execute arbitrage setups using equity vs. futures and equity vs. options. You will learn how to identify price mismatches, manage spreads, and structure your trades for low-risk returns.

Course Highlights :

- Learn how to execute arbitrage trades using futures and options

- Identify low-risk opportunities between spot and derivative markets

- A practical arbitrage strategy using real market instruments

- Manage capital efficiently while limiting directional risk

Who is this course for :

- Traders looking for low-risk, non-directional trading opportunities

- Intermediate market participants wanting to explore arbitrage setups

- Investors seeking steady returns with limited market exposure

- Those interested in professional trading techniques used by institutions

- Anyone looking to diversify beyond directional trading strategies

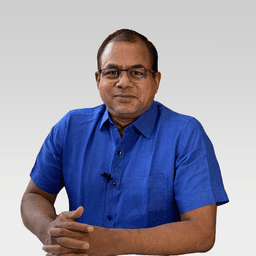

Learn From - Rajendra Suryawanshi

25+ Years

Rajendra Suryawanshi

He is a SEBI-registered Research Analyst (INH000007094) known for developing a low-risk, high-reward strategy after years of research. For more than 12 years, he has been known for his accurate predictions on Nifty and Bank Nifty. He is embarked on the journey to train young minds.Frequently Asked Questions

Do I need advanced market knowledge to understand arbitrage?

Is arbitrage trading risk-free?

Will I learn how to manage position sizing and capital?

How long will I have access to this course?

Will I get a certificate of completion?

Why is this course so affordable?

₹---

1050 learners have enrolled