Foundation of Technical Analysis by Milind Upasani

What You Will Learn

How to read market trends through candlesticks and Dow Theory

Key indicators like Moving Averages, MACD, and RSI

Fundamentals of price action and market momentum

Basics of fundamental analysis and importance of the techno funda approach

Your Course Overview

5 sections • 12 topics • 7 hrs 3 mins content

1. Introduction

46 mins

Why techno funda analysis

Start Learning

2. Basics of Technical Analysis

2 hrs

Understanding price through candles

Start Learning

Dow theory - I

Start Learning

Dow theory - II

Start Learning

Dow theory - III

Start Learning

3. Technical Indicators

2 hrs

Moving averages - I

Start Learning

Moving averages - II

Start Learning

Moving average convergence & divergence (MACD)

Start Learning

Relative strength index (RSI)

Start Learning

4. Basics of Fundamental Analysis

58 mins

Overview of fundamental analysis

Start Learning

5. Next Step

1 min

How to take your trading skills to the next level

Start Learning

Trading Mentorship Program by Milind Upasani

Download

About The Course

Foundation of Technical Analysis by Milind Upasani is a beginner-friendly course that builds your core understanding of how markets work through technical tools. Whether you are completely new or want to strengthen your fundamentals, this course walks you through how to read price movements, interpret trends, and apply indicators in real market scenarios. It also introduces the concept of techno-funda analysis, where technical and fundamental insights combine for smarter decision-making.

In Lesson 1: Introduction, you will learn the importance of techno-funda analysis and how combining both approaches can enhance your trading and investing skills.

In Lesson 2: Basics of Technical Analysis, you will understand price movement using candlestick charts and explore the foundational principles of Dow Theory across three detailed sessions.

In Lesson 3: Technical Indicators, you will explore how to use Moving Averages, MACD, and RSI to identify trends, momentum, and entry/exit signals.

In Lesson 4: Basics of Fundamental Analysis, you will gain an introductory understanding of evaluating stocks using core financial and business fundamentals.

Course Highlights :

- How to read market trends through candlesticks and Dow Theory

- Key indicators like Moving Averages, MACD, and RSI

- Fundamentals of price action and market momentum

- Basics of fundamental analysis and importance of the techno funda approach

Who is this course for :

- Beginners looking to learn the basics of technical analysis

- Traders who want to strengthen their foundational skills

- Investors seeking to understand chart-based decision-making

- Anyone curious about combining technical and fundamental analysis

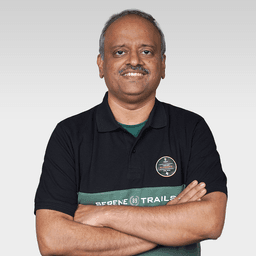

Learn From - Milind Upasani

Founder, Learn2Invest

Full-Time Trader

25+ Years

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.

Frequently Asked Questions

Do I need prior experience in technical analysis to take this course?

What indicators will I learn in this course?

Can I use this course for both trading and investing?

Will I get real examples of trades?

How long will I have access to this course?

Will I get a certificate of completion?

Why is this course so affordable?

₹---

1017 learners have enrolled