Large Cap Investing Strategy by Milind Upasani

What You Will Learn

How to read market trends through candlesticks and Dow Theory

Key indicators like Moving Averages, MACD, and RSI

Fundamentals of price action and market momentum

Importance of the techno funda approach

Basics of large-cap investing and wealth creation

How to identify high-quality large-cap stocks

Use scanners for quick and efficient stock discovery

Your Course Overview

7 sections • 14 topics • 8 hrs 3 mins content

1. Introduction

46 mins

Why techno funda analysis

Start Learning

2. Basics of Technical Analysis

2 hrs

Understanding price through candles

Start Learning

Dow theory - I

Start Learning

Dow theory - II

Start Learning

Dow theory - III

Start Learning

3. Technical Indicators

2 hrs

Moving averages - I

Start Learning

Moving averages - II

Start Learning

Moving average convergence & divergence (MACD)

Start Learning

Relative strength index (RSI)

Start Learning

4. Basics of Fundamental Analysis

58 mins

Overview of fundamental analysis

Start Learning

5. Large cap Investing Strategy

41 mins

Basics of strategy

Start Learning

6. How to Find Stocks

17 mins

Scanner for stocks selection

Start Learning

7. Next Step

1 min

How to take your trading skills to the next level

Start Learning

Trading Mentorship Program by Milind Upasani

Download

About The Course

Large Cap Investing Strategy is a course designed to help you build a solid foundation in long-term investing with a focus on leading large-cap companies. You will learn how to identify fundamentally strong stocks, analyze market trends using simple technical tools, and create a stable, growth-oriented portfolio. The course also introduces the concept of techno-funda analysis, combining technical and fundamental insights to make smarter investment decisions. By the end, you will have a clear, structured approach to investing that helps you grow wealth confidently and consistently over time.

In Lesson 1: Introduction, you will learn the importance of techno-funda analysis and how combining both approaches can enhance your trading and investing skills.

In Lesson 2: Basics of Technical Analysis, you will understand price movement using candlestick charts and explore the foundational principles of Dow Theory across three detailed sessions.

In Lesson 3: Technical Indicators, you will explore how to use Moving Averages, MACD, and RSI to identify trends, momentum, and entry/exit signals.

In Lesson 4: Basics of Fundamental Analysis, you will gain an introductory understanding of evaluating stocks using core financial and business fundamentals.

In Lesson 5: Large Cap Investing Strategy, you will learn the fundamentals of large-cap investing, why these companies form the backbone of a strong portfolio, and how to build a strategy around them. The module also covers how to align your investment goals with the performance of established market leaders.

In Lesson 6: How to Find Stocks, you will explore how to find the best-performing large-cap stocks using scanners. You will understand how to filter stocks based on volume, trends, and fundamentals to identify the right opportunities for long-term investment.

Course Highlights :

- How to read market trends through candlesticks and Dow Theory

- Key indicators like Moving Averages, MACD, and RSI

- Fundamentals of price action and market momentum

- Importance of the techno funda approach

- Basics of large-cap investing and wealth creation

- How to identify high-quality large-cap stocks

- Use scanners for quick and efficient stock discovery

Who is this course for :

- New investors who want to start with safer, high-quality stocks

- Long-term investors looking to build a reliable large-cap portfolio

- Traders who wish to add stable investments to balance their active trades

- Anyone aiming to understand the process of selecting and investing in blue-chip companies

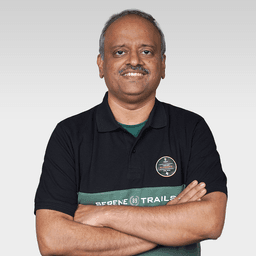

Learn From - Milind Upasani

Founder, Learn2Invest

Full-Time Trader

25+ Years

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.

Frequently Asked Questions

Do I need any prior investing experience for this course?

No, this course is beginner-friendly and perfect for those starting their investment journey.

Can I apply this strategy for long-term wealth building?

Yes, this strategy is specifically designed for consistent long-term returns.

Is this course suitable for working professionals?

Absolutely. This strategy is designed for investors who prefer a systematic and time-efficient approach.

How long will I have access to this course?

This course will be accessible for 1 year from the date of purchase.

Will I get a certificate of completion?

Yes, you will receive a certificate signed by Milind Upasani on completing this course.

₹---

995 learners have enrolled