Basics of Options Trading

What You Will Learn

Fundamentals of options trading

Key option trading strategies

Applying the right options trading strategies at the right time

Bonus: 3 exclusive strategy hacks from Abhishek Kar

Your Course Overview

5 sections • 35 topics • 4 hrs 13 mins content

1. Option Fundamentals and Core Concepts

54 mins

Understanding Options with Real-Life Examples

Start Learning

Understanding Options in the Stock Market

Start Learning

What is a Call Premium?

Start Learning

Abhishek Kar's Strategy Hack #1

Start Learning

Exploring the Advantages of Options Trading

Start Learning

Options Buying v/s Options Selling

Start Learning

Essential Terminologies in Options Trading

Start Learning

Comprehensive Glossary of Options (Downloadable PDF)

Download

What are Intrinsic and Extrinsic Option Values?

Start Learning

Abhishek Kar's Strategy Hack #2

Start Learning

Understanding Moneyness in Options Trading

Start Learning

Abhishek Kar's Strategy Hack #3

Start Learning

2. Mastering Open Interest and Option Greeks

1 hr

Interpretation and Significance of Long-Short Positions in Options

Start Learning

Navigating the Option Chain: Option Chain Analysis

Start Learning

Introduction to Option Greeks

Start Learning

Gamma Blast (Expiry Day Example)

Start Learning

Exploring the Delta-Gamma Relationship

Start Learning

Relation between Delta and Gamma (Downloadable PDF)

Download

Understanding Option Greeks on Live Trading Screens

Start Learning

Option Greeks Explained with Stock Examples

Start Learning

3. Volatility Index and Risk Management

31 mins

Introduction to Volatility

Start Learning

Breaking Down the Volatility Index (VIX) for Easy Understanding

Start Learning

Mastering VIX: In-Depth Explanation and Utilization

Start Learning

Understanding the Put-Call Ratio (PCR)

Start Learning

4. Essential Options Trading Strategies

25 mins

Understanding Straddle and Strangle Strategies

Start Learning

Iron Condor and Butterfly Strategies Explained

Start Learning

What is a Bull Call Spread?

Start Learning

Exploring Bear Put Spread

Start Learning

Exploring Bear Call Spread

Start Learning

What is a Bull Put Spread?

Start Learning

5. Ratios, Payoff Charts, and Trading Psychology

1 hr

Ratios in Options Trading Explained

Start Learning

Mastering Payoff Charts

Start Learning

Importance of Psychology of Trading - Part 1

Start Learning

Importance of Psychology of Trading - Part 2

Start Learning

Strategies Application (Live Examples)

Start Learning

About The Course

Welcome to Basics of Options Trading course on Upsurge.club, where we will lay a strong foundation for you to start your options trading journey. This course is one of the best online options trading courses for individuals looking to learn options trading from scratch.

In Lesson 1, Option Fundamentals and Core Concepts, we start with the fundamental principles of options trading, understanding them through real-life examples, making even the most complex option trading concepts seem simple. You will see how options work in the stock market and learn the concept of a call premium. As we continue learning, we will compare the advantages of buying and selling options along with all the options trading terms so you can speak the language of options trading fluently. You can also download a glossary of these terms for your offline learning. Next, we will study the intrinsic and extrinsic option values and conclude the module by exploring the concept of moneyness. In bonus content, we have 2 exclusive strategy hacks from Abhisek Kar that wrap up the module with some practical strategy tips.

In Lesson 2, Mastering Open Interest and Option Greeks, you will level up your options trading skillset. You will begin by understanding long-short positions in options and their significance. Then, you will learn about Option Chain Analysis so you can learn to navigate the option chain effectively. Next, we dive deep into Option Greeks - Delta, Gamma, Theta, and Vega - and how they impact options pricing. You will understand Gamma Blast through an expiry day example in order to make complex concepts simpler. We will also explore the relationship between Delta and Gamma. To conclude this module, you will enhance your practical knowledge and learn to interpret Option Greeks using live trading screens and refine this with stock examples.

Lesson 3, Volatility Index and Risk Management, focuses on volatility, a key factor in options trading. You will learn about volatility and its impact on options trading. We will break down the Volatility Index (VIX) into easy-to-understand parts so that you grasp the concept thoroughly. Mastering the VIX is essential, and so we will also provide an in-depth explanation of its use in trading strategies. Plus, you will gain a comprehensive understanding of the Put-Call Ratio (PCR), an important tool for risk assessment in options trading.

In Lesson 4, Essential Options Trading Strategies, we shift our focus to practical options trading strategies. We will explore essential strategies such as Straddle and Strangle, providing you with a solid foundation in their application. You will also gain insights into advanced strategies like the Iron Condor and Butterfly, with explanations on when and how to use them effectively. To navigate different market conditions, we will also understand call and put spread strategies.

In the final lesson, Ratios, Payoff Charts, and Trading Psychology, we will cover a range of topics essential for your options trading skills. You will learn how to use ratios in options trading and skillfully interpret payoff charts. Understanding the psychology of trading is a critical aspect of success, and we will understand it by breaking it down into two comprehensive parts. To tie it all together, we will showcase these strategies in action through live examples, allowing you to witness real-life applications.

By the end of this comprehensive online option trading course, you will have the knowledge and practical skills required to excel in the world of options trading. Whether you're a beginner looking to build a strong foundation or an experienced trader aiming to enhance your strategies, our Basics of Options Trading course has you covered. Get ready to unlock the potential of options trading and elevate your trading journey.

Course Highlights:

- Build a strong foundation in options trading principles with real-life examples.

- Master the intricacies of open interest and option Greeks for more informed trading decisions.

- Understand the role of volatility, break down the Volatility Index (VIX), and learn to utilize it effectively in your strategies.

- Learn ratios, payoff charts, and the psychology of trading, with practical applications in live examples.

Who is this course for:

- Beginners looking to build a strong foundation in options trading from scratch.

- Anyone who is interested in learning a diverse range of options trading strategies.

- Enthusiasts eager to gain exclusive strategy hacks from Abhishek Kar.

- Anyone who wants to unlock the power of option Greeks for trading success.

- Anyone who is interested in understanding the psychology of trading and building emotional resilience.

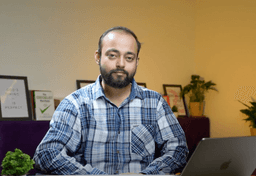

Learn From - Abhishek Kar

883K+ Subscribers

10+ Years

Full-Time Trader

Abhishek Kar

Abhishek Kar, a 10+ years experienced derivatives trader, is a sought-after keynote speaker at esteemed institutions like IIM, IITK, and more. With 883K+ YouTube subscribers, he excels at simplifying complex trading concepts.Frequently Asked Questions

How can I start trading in options?

What is call and put in options?

Put: A put option is a contract granting the holder the right (but not the obligation) to sell an underlying asset at a specified price (strike) before or at the option's expiration.

Check out options trading courses to explore more about options trading.

Does this course cover basic options trading strategy?

Option Scalping Strategy and Swing Trading and Scalping Strategy courses cover the advanced options trading strategy.

What is upsurge.club PRO?

Is the Basics of Options Trading course is in English language?

₹---

OR

Get this course, plus access to other 75+ courses with Upsurge.club PRO plan

14348 learners have enrolled