Swing Trading Strategy Using Relative Strength

What You Will Learn

How to use RSI, moving averages, and MACD to analyze stock momentum

Applying the Relative Strength strategy with clear, rule-based execution

Identifying high-momentum trading opportunities using dashboards and scanners

Combining fundamental analysis with technical momentum for better stock selection

Building consistency through effective portfolio management and trading psychology

Your Course Overview

6 sections • 9 topics • 10 hrs 23 mins content

1. Introduction

1 hr

Overview of technical analysis

Start Learning

2. Technical indicators

2 hrs

Moving averages & RSI

Start Learning

Moving average convergence divergence (MACD)

Start Learning

3. Basics of Fundamental Analysis

34 mins

Overview of fundamental analysis

Start Learning

4. Relative Strength Strategy

3 hrs

Relative strength momentum strategies

Start Learning

Strategy dashboard and scanners

Start Learning

5. Fundamental Analysis and Stocks Selection

26 mins

Relative strength fundamental scanners

Start Learning

6. Portfolio Management and Trading Psychology

1 hr

How to manage portfolio effectively

Start Learning

Understanding trading psychology

Start Learning

About The Course

Swing Trading Strategy Using Relative Strength is a course that focuses on identifying strong, trending stocks by combining technical and fundamental analysis. Built around Relative Strength principles, this course helps you spot outperforming stocks and build high-conviction trades backed by clear logic and discipline. From technical indicators like Moving Averages, RSI, and MACD to fundamental screening tools, this course walks you through a complete momentum trading process. You will also learn to use custom scanners and dashboards to simplify stock selection and stay aligned with market strength.

In Lesson 1, Introduction, you will get an overview of technical analysis and understand why momentum strategies are effective for stock trading.

In Lesson 2, Technical Indicators, you will learn how to use Moving Averages, RSI, and MACD to identify momentum trends and strength shifts.

In Lesson 3, Basics of Fundamental Analysis, you will explore how basic financial filters can complement technical analysis for higher probability trades.

In Lesson 4, Relative Strength Strategy, you will learn to apply the Relative Strength Momentum strategy using scanners and dashboards to spot outperforming stocks.

In Lesson 5, Fundamental Analysis and Stock Selection, you will use relative strength-focused fundamental scanners to shortlist fundamentally strong, high-momentum stocks.

In Lesson 6, Portfolio Management and Trading Psychology, you will learn how to manage capital efficiently and build the discipline and mindset required to stick with winning positions.

Course Highlights :

- How to use RSI, moving averages, and MACD to analyze stock momentum

- Applying the Relative Strength strategy with clear, rule-based execution

- Identifying high-momentum trading opportunities using dashboards and scanners

- Combining fundamental analysis with technical momentum for better stock selection

- Building consistency through effective portfolio management and trading psychology

Who is this course for :

- Traders looking to build a momentum-based trading system

- Swing or positional traders seeking consistent stock selection methods

- Anyone wanting to combine technical momentum with fundamental filters

- Beginners who want a rules-based strategy that reduces emotional trading

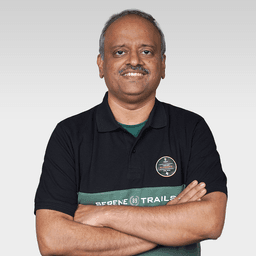

Learn From - Milind Upasani

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.Frequently Asked Questions

Is this course suitable for beginners?

What is the Relative Strength Momentum Strategy?

Which indicators are used in this strategy?

Will I learn how to make and use stock scanners for trade opportunities?

How long will I have access to this course?

Will I get a certificate of completion?

Why is this course so affordable?

₹---

This Course is not included in PRO