Trading Momentum Stocks using Sectoral Analysis

What You Will Learn

Understand the concept and importance of sectoral analysis in trading

Identify which sectors are gaining or losing momentum in real time

Track multiple sectors and stocks efficiently using data-driven dashboards

Use momentum dashboards to find optimal entry and exit points

Build a systematic trading process that aligns with sector strength

Your Course Overview

4 sections • 7 topics • 1 hr 20 mins content

1. Basics of Sectoral Analysis

33 mins

Need of sectoral analysis

Start Learning

2. Sectors and Stocks Tracking

11 mins

How to track multiple sectors

Start Learning

How to track stocks

Start Learning

3. How to find Entry and Exit

33 mins

Sectoral analysis dashboard

Start Learning

Dashboard for momentum stocks

Start Learning

4. Next Step

1 min

How to take your trading skills to the next level

Start Learning

Trading Mentorship Program

Download

About The Course

Trading Momentum Stocks Using Sectoral Analysis is a course designed to help traders identify the strongest market sectors and pick momentum stocks within them. You will learn how to analyze sectors effectively, spot early signs of strength or weakness, and use dashboards to make informed trading decisions. This course goes beyond just stock picking; it teaches you how to understand sectoral rotation, track multiple sectors efficiently, and align your trades with broader market momentum. Whether you’re trading swing or positional setups, this course helps you build a structured process to trade smarter and stay ahead of market trends.

In Lesson 1, Basics of Sectoral Analysis, you will learn the importance of sectoral analysis and why it’s essential for identifying the best trading opportunities. This module helps you understand how money flows between sectors and how to use this knowledge to trade in the direction of institutional momentum.

In Lesson 2, Sector and Stocks Tracking, you will explore practical methods to track multiple sectors simultaneously and monitor leading and lagging stocks. You will also learn how to maintain a structured tracking system that simplifies identifying which stocks are driving sectoral strength.

In Lesson 3, How to Find Entry and Exit, you will discover how to use dashboards and analytical tools to find precise entry and exit points for momentum trades. This module also covers how to use a momentum dashboard to time trades effectively and capture high-probability moves with confidence.

Course Highlights :

- Understand the concept and importance of sectoral analysis in trading

- Identify which sectors are gaining or losing momentum in real time

- Track multiple sectors and stocks efficiently using data-driven dashboards

- Use momentum dashboards to find optimal entry and exit points

- Build a systematic trading process that aligns with sector strength

Who is this course for :

- Traders who want to refine their stock selection process using sectoral momentum

- Swing and positional traders who seek to trade with institutional flow

- Intraday traders who want to identify short-term sectoral strength

- Analysts and investors looking to add a professional edge to their market study

- Anyone who wants to trade in sync with broader market momentum instead of random setups

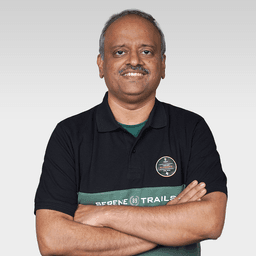

Learn From - Milind Upasani

Founder, Learn2Invest

Full-Time Trader

25+ Years

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.

Frequently Asked Questions

What is sectoral analysis, and why is it important?

Sectoral analysis helps you understand which industries or sectors are performing better than others. Trading in strong sectors increases your chances of success by aligning your trades with overall market momentum.

Can I use this strategy for intraday trading?

Yes, while the course focuses on swing and positional setups, the same principles can be applied to intraday trades.

Will I get access to tools or dashboards?

Yes, you’ll learn how to use dashboards for both sectoral analysis and momentum stock identification.

How long will I have access to this course?

This course will be accessible for 1 year from the date of purchase.

Will I get a certificate of completion?

Yes, you will receive a certificate signed by Milind Upasani on completing this course.

Why is this course so affordable?

At Upsurge.club, we aim to make quality stock market education accessible to as many individuals as possible by offering budget-friendly courses. This helps interested learners to improve their trading and investing skills without financial constraints.

₹---

1036 learners have enrolled