Weekend Investing Strategy by Milind Upasani

What You Will Learn

How to use RSI, moving averages, and MACD to identify breakout opportunities

Step-by-step application of the weekend investing strategy with entry & exit rules

How to scan for breakout and trending stocks using both technical & fundamental screeners

Portfolio management and trading psychology for consistent results

Your Course Overview

6 sections • 15 topics • 13 hrs 34 mins content

1. Introduction

1 hr

Overview of technical analysis

Start Learning

2. Technical indicators

2 hrs

Moving averages & RSI

Start Learning

Moving average convergence divergence (MACD)

Start Learning

3. Basics of Fundamental Analysis

31 mins

Overview of fundamental analysis

Start Learning

4. Weekend Investing Strategies

6 hrs

Breakout momentum strategy

Start Learning

Breakout strategy scanners

Start Learning

Techno funda scanner

Start Learning

How to plan exit in breakout strategy

Start Learning

Investing using the CANSLIM strategy

Start Learning

Trend following strategy

Start Learning

Value investing strategy

Start Learning

5. Portfolio Management and Trading Psychology

2 hrs

How to manage portfolio effectively

Start Learning

Understanding trading psychology

Start Learning

6. Next step

1 min

How to take your trading skills to the next level

Start Learning

Trading Mentorship Program by Milind Upasani

Download

About The Course

Weekend Investing Strategy by Milind Upasani is a strategy-focused course for part-time traders and investors who want to manage their portfolios effectively with minimal screen time. This course introduces multiple rule-based strategies including breakout momentum, trend-following, CANSLIM, and value investing. You will learn how to use technical indicators like Moving Averages, RSI, and MACD, and apply custom scanners to identify high-potential stocks. Through a combination of technical and fundamental analysis, you will gain the tools to build a focused watchlist, make data-driven decisions, and stay consistent with defined entry and exit rules. Whether you are investing in your spare time or building long-term positions, this course provides a full framework to act with confidence over the weekend and execute with clarity during the week.

In Lesson 1, Introduction, you will understand the foundation of technical analysis and its role in weekend-based investing.

In Lesson 2, Technical Indicators, you will explore how to use Moving Averages, RSI, and MACD for identifying trends and momentum.

In Lesson 3, Basics of Fundamental Analysis, you will learn the core fundamentals that support long-term investing and smart stock selection.

In Lesson 4, Weekend Investing Strategies, you will dive into multiple rule-based strategies including the breakout momentum strategy, CANSLIM, trend-following, and value investing. You will also learn how to use strategy-specific scanners and plan exits with precision.

In Lesson 5, Portfolio Management and Trading Psychology, you will gain insights into portfolio structuring, risk control, and the mindset needed for consistent weekend-based investing.

Course Highlights :

- How to use RSI, moving averages, and MACD to identify breakout opportunities

- Step-by-step application of the weekend investing strategy with entry & exit rules

- How to scan for breakout and trending stocks using both technical & fundamental screeners

- Portfolio management and trading psychology for consistent results

Who is this course for :

- Part-time traders and weekend investors looking to reduce screen time

- Traders seeking rule-based strategies that don’t require daily monitoring

- Investors wanting to blend technical and fundamental analysis effectively

- Beginners looking for simplified, actionable investment strategies

- Anyone who wants to approach the market with a structured plan each weekend

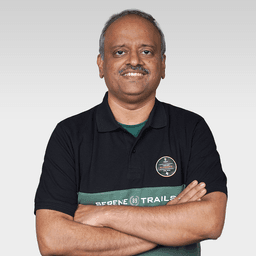

Learn From - Milind Upasani

Founder, Learn2Invest

Full-Time Trader

25+ Years

Milind Upasani

Milind Upasani is a seasoned trader and mentor with over 25 years of experience in the stock market. He specializes in positional and swing trading, using a strategic mix of technical indicators and fundamental analysis. His approach emphasizes scanner-based alerts and disciplined trade execution. As an educator, he actively mentors retail investors through courses and webinars, sharing insights to build consistent, informed traders.

Frequently Asked Questions

Do I need to monitor the market daily for this strategy?

Can beginners take this course?

Which indicators are used in this strategy?

Is this course focused only on one strategy?

Will I learn how to make and use stock scanners for trade opportunities?

How long will I have access to this course?

Will I get a certificate of completion?

₹---

1014 learners have enrolled